Rating Information 2023-2024

To view the 2023-2024 Budget Bulletin, click on the below images or green button.

We have also provided links to the 2023-2024 Objectives and Reasons for Differential Rating and the 2023-2024 Revenue Strategy.

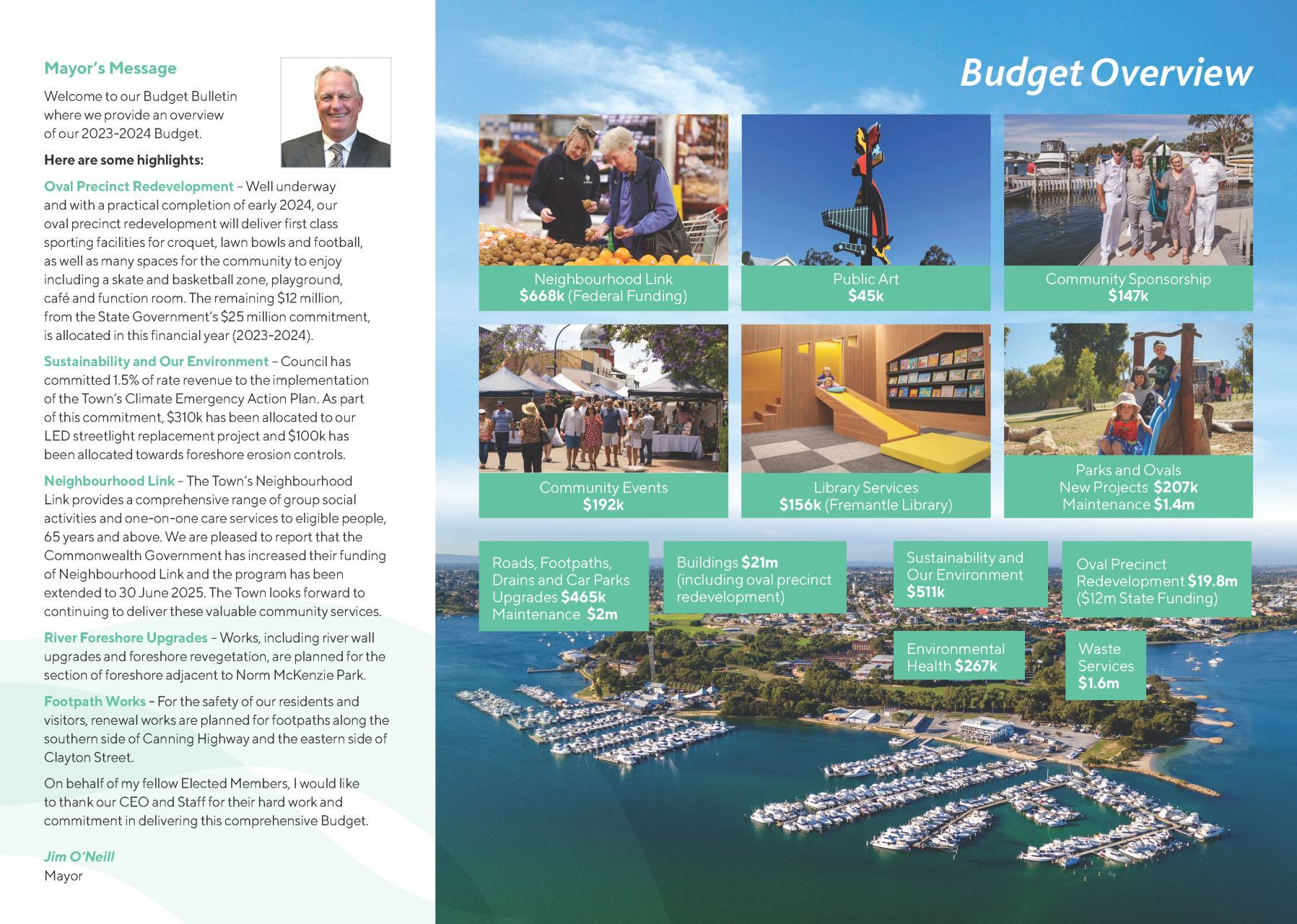

2023-2024 Budget Bulletin

2023-2024 Objectives and Reasons

2023-2024 Revenue Strategy

Pay Your Rates

The Town of East Fremantle is pleased to provide a variety of rates payment options:

- online via the Town's website

- by telephone

- Bpay

- in person

- mail.

Mastercard, Visa and AMEX credit and debit cards accepted.

Pay Rates Online

Pay by VISA, Mastercard or AMEX

Pay by telephone

To pay your rate notice by phone, please call 1300 276 468 anytime.

Your rate notice will have the biller code, customer reference number and amount to pay.

Bpay

Contact your participating financial institution to make a payment from your nominated account.

Please see the front of your Rate Notice for find the Biller Code and your reference number.

Note: Credit Card payment is not available with this option.

Pay in person

Payment can be made by cash, cheque or EFTPOS (including credit card) on presentation of your rates notice INTACT to:

Town Hall, 135 Canning Highway, East Fremantle

Pay by mail

Please make cheques payable to the Town of East Fremantle, and crossed ‘Not Negotiable’. Complete and insert cheque and this payment slip only. The top portion of the notice should be retained as your record. No receipt will be issued.

Adopted Differential Rates 2023/24

In accordance with Section 6.36 of the Local Government Act 1995, the Town of East Fremantle has adopted the following Differential General Rates and Minimum Payments for the 2023/24 financial year, effective from 1 July 2023 to 30 June 2024.

|

Residential (GRV)

|

6.8930 cents in the dollar (Minimum rate of $1,243)

|

|

Commercial (GRV)

|

11.6840 cents in the dollar (Minimum rate of $1,859)

|

Download the Objects & Reasons for Differential General Rates and Minimum Payments

Understanding Your Rate Notice

|

1. How are your rates calculated ?

Your rates are calculated by multiplying a property's Gross Rental Value (GRV) or Unimproved Value (UV) by the rate in the dollar set by Council.

|

6. Payment options

The Town of East Fremantle offers ratepayers three options to pay your rates.

- In full within 35 days.

- By instalments (2 or 4 payments).

- By special payment arrangement.

|

|

2. Emergency Services Levy

The Emergency Services Levy (ESL) is a State Government levy applicable to All properties in Western Australia. The ESL levy is included on your rates notice. Local Governments collect the levy on behalf of the Fire and Emergency Services Authority (FESA) and forward the funds directly to FESA, which then redistributes the money to the emergency services throughout the state.

|

7. Customer Reference Number

Your Payment Account Number is a unique number allocated to your rates account and required to reference when you are making a payment online.

|

|

3. Pool Inspection Fee

A swimming pool inspection fee is payable for each property with a pool or spa. As the inspection is conducted every four years the fee is broken into four instalments that are included in the property rates levied each year. Refer to the Towns current schedule of fees and charges for the current amount payable.

|

8. Assessment Number

Your Assessment Number is a unique number allocated to your property address and rates account.

|

|

4. Additional Bins

Residential properties in East Fremantle receive a general FOGO System, consisting of (one) 140 litre general waste service, (one) 240 litre lime green-lidded FOGO bin and (one) 240 litre recycling bin. Property owners may request an additional waste service and the additional charge for each extra bin, will be placed on your rates notice.

|

9. Gross Rental Valuation (GRV)

The Gross Rental Value, or GRV, represents the gross annual rental that a property might reasonably be expected to earn annually if it were rented. The GRV is calculated for all rateable and leviable properties in Western Australia regardless of whether the property is being rented or owner occupied and determined by Landgate, Western Australia's land information authority.

|

|

5. Total Due

The total due is a combination of all the individual charges itemised on your rates notice and is the total amount due for payment.

|

10. Rate in the Dollar

As part of the annual budget resolution, a local government must set the general ‘rate in the $’. The rate in the dollar is adopted by Council and is multiplied by the annual statutory valuation for the land to determine the amount of rates that will be levied on each parcel of rateable land.

|

Register for e-Rates

With e-Rates you can choose to receive your rate notices by email instead of by post. A summary of your bill will be sent directly to your nominated email address with links that allow you to view a PDF version of your rates notice, pay your bill online and receive a copy of your annual tip pass to download.

Benefits of e-Rates

- Help the environment by reducing paper consumption.

- Access and pay your rates at anytime and anywhere.

- Set calendar alerts to remind you to pay your rates on time.

- Reduce paper clutter at home.

Switching to e-Rates is easy.

Register for e-rates

Remember to click the "Register" button once completed. Please note, by choosing to receive your rates notices by email you will no longer receive a paper copy in the mail.

How are rates calculated?

The amount of rates payable is determined by three factors: the method of valuing the land; the valuation of the land and improvements; and the rate in the dollar set by Council and applied to that valuation of land. The Minister for Local Government determines the appropriate method for the valuation of the land according to the relevant legislation and the rating policy on the valuation of land: that is, whether the unimproved value or the gross rental value of the land applies. This is based on the purpose for which the land is held or used. The Valuer General values the land in line with the Valuation of Land Act 1978. For More information please refer to the following link.

General’s Guide to Rating and Taxing Values.

As part of its budgetary process, the Town of East Fremantle establishes its budget deficit and set its rates to cover this shortfall. These will be imposed as a rate in the dollar, which will be applied to the valuation determined by Landgate, Western Australia's land information authority.

For Example

In the 2023/2024 financial year, Council has determined that the rate in the dollar to be applied for rates is 6.8930 cents in the dollar for Residential Properties. This means that 6.8930 cents will be levied as rates for every dollar of Gross Rental Valuation assigned to a property, subject to the differential rates category it falls into.

Landgate may determine that a brick and tiled house in East Fremantle containing 4 bedrooms, kitchen, 2 bathrooms, laundry, and a double carport could attract a rent after basic expenses of $686 per week. Rent of $686 per week, multiplied by 52 weeks per year gives a Gross Rental Value of $35,672.

GRV = $686 x 52 = $35,672

The rates to be levied against that particular property would be:

Rates = $35,672 x 6.8930 divided by 100 = $2,458.87

Differential Rates and Minimum Payments

Rates are a tax levied on all rateable properties within the boundaries of the Town of East Fremantle in accordance with the Local Government Act 1995. The overall objective of the adopted rates in the Budget is to provide for the net funding requirements of the Town’s services, activities, financing costs and the current and future capital requirements of the Town, after taking into account all other forms of revenue.

The formulation of a rating system is about achieving a means by which Council can raise sufficient revenue to pay for the services it provides. Throughout Australia, the basis of using property valuations has been found to be the most appropriate means of achieving rating equity; however, the achievement of a wholly equitable rating system for all properties, in all areas, is a difficult task if it is based on the property valuations alone. For this reason there are refinement options made available, such as differential rating, the Town of East Fremantle has elected to use.

In Western Australia, land is valued by Landgate, Valuation Services and those values are forwarded to each local government for rating purposes. Two types of values are calculated – Gross Rental Value (GRV) which generally applies for urban areas; and Unimproved Value (UV) which generally applies for rural land. GRV means the gross annual rental that the land might reasonably be expected to realise if let on a tenancy from year to year upon condition that the landlord was liable for all rates, taxes and other charges thereon and the insurance and outgoings necessary to maintain the value of the land. A local government may impose a single general rate which applies to all of the properties in the unimproved value or gross rental value category. Alternatively the local government can distinguish between land in either category on the basis of its zoning, use or whether it is vacant land, or a combination of these factors, and apply a differential general rate to each.

A local government may impose differential general rates according to any, or a combination, of the following.

Characteristics of land

-

the purpose for which the land is zoned, whether or not under a local planning scheme or improvement scheme in force under the Planning and Development Act 2005;

-

or a purpose for which the land is held or used as determined by the local government; or

-

whether or not the land is vacant land; or any other characteristic or combination of characteristics prescribed.

The Valuer General values the land in accordance with the provisions of the Valuation of Land Act 1978. A rate in the dollar is imposed by the local government on this valuation to determine a ratepayer’s rates liability. A minimum payment can be imposed by a local government irrespective of what the rate assessment would be if the rate is applied to the property valuation. The purpose of the imposition of a minimum payment is generally to ensure that every ratepayer makes a reasonable contribution to the rate burden. The Town has imposed on any rateable land in East Fremantle a minimum payment which is greater than the general rate which would otherwise be payable on that land.

The following are the Differential General Rates and Minimum Payments for the Town of East Fremantle for the 2023/24 financial year, effective from 1 July 2023 to 30 June 2024:

| Residential (GRV) |

6.8930 cents in the dollar |

| Commercial (GRV) |

11.6840 cents in the dollar |

| Minimum (Residential) |

$1243.00 |

| Minimum (Commercial) |

$1859.00 |

Additional Bins

The three bin Food Organics Garden Organics (FOGO) system was successfully introduced to East Fremantle’s residents in the first week of July 2019.

Additional bins can be obtained outside the standard general waste service at an additional cost. Waste Service Charges are levied as per the Town of East Fremantle’s Schedule of Fees and charges adopted by Council each year.

Waste Service Fees are an annual fee and calculated on a pro –rata basis from the date the bin is delivered to the premises and will be included on a property rates notice, itemised as a separate levy.

Ratepayers will be required to complete a form for all additional bins requested for a property. A review of the application will be completed by the Waste Education Officer to ensure all residents are using the FOGO system correctly and receiving the appropriate number of bins to promote efficient waste management.

Pursuant to section 67 of the Waste Avoidance and Resources Recovery Act 2007, Council imposes the following charges for the removal and deposit of commercial waste and additional receptacle services:

The following are the charges for additional bins for the 2023/24 financial year, effective from 1 July 2023 to 30 June 2024:

|

Description

|

Fee

|

|

General Waste Bin

|

$261.20 per annum

|

|

FOGO Waste Bin

|

$261.20 per annum

|

|

Recycling Bin

|

$261.20 per annum

|

|

Bulk Bin Services

|

Cost + 15%

|

|

Commercial Property 2MGB and 3MGB FOGO Service

|

$642.00 per annum

|

|

3 bin collection Sporting Clubs

|

$642.00 per annum

|

Swimming Pool Inspection Fees

Pursuant to section 245A (8) of the Local Government (Miscellaneous Provisions) Act 1960, and regulation 53 of the Building Regulations 2012, Council has imposed a private swimming pool four yearly inspection fee of $140.00 for each property where a private swimming pool is located, charged at $35.00 per annum.

Rate Payers must let the Town know in writing by emailing admin@eastfremantle.wa.gov.au if they no longer have a swimming pool. This way, we know that inspections at your property are not required.

Emergency Services Levy

The Emergency Services levy is a State Government charge applicable to all properties in WA, which is invoiced and collected by local governments on behalf of the Department of Fire and Emergency Services (DFES). The levy provides fire and emergency services including fire stations, volunteer fire brigades, SES units and more. The amount to be collected, and the applicable rates and charging parameters, are declared annually by the Minister of Emergency Services. Please note late payment of the ESL Levy will accrue penalty interest daily, at a rate of 11% per annum.

For more information, call on free-call 1300 136 099

VISIT DFES

What is my property assessment number?

The Assessment Number is a unique number allocated to your property address. You may reference this number when you contact the Town of East Fremantle about your property or rates account.

Gross Rental Valuation (GRV)

In Western Australia, land is valued by Landgate Valuation Services and those values are forwarded to each local government for rating purposes. Two types of values are calculated:

- Gross Rental Value (GRV) which generally applies for urban areas; and

- Unimproved Value (UV) which generally applies for rural land.

GRV means the gross annual rental that the land might reasonably be expected to realise if let on a tenancy from year to year upon condition that the landlord was liable for all rates, taxes and other charges thereon and the insurance and outgoings necessary to maintain the value of the land. GRV general valuations are currently carried out on a triennial basis in the Perth metropolitan area. The date of valuation in relation to a general valuation is fixed by the Valuer General. Values are then determined relative to sales and rentals that are negotiated in the marketplace at or close to the date of valuation, which is set at 1 August two years prior to the effective date. The date of valuation is not the same as the date that the GRV comes into force. The date in force is the date from which the values must be used by the rating and taxing authority, which is 1 July for GRVs. The Town of East Fremantle has received the next General Revaluation with those values in effect from 1 July 2023.

Your valuation (GRV or UV) is only one factor used to calculate your rates notice. The Valuation of Land Act 1978 (as amended) Part IV sets out how valuation objections may be lodged. A property owner may lodge an objection against the valuation of a property within 60 days of the date of issue of a rates notice. The online objection form is now available on Landgate’s webpage

Lodge an Objection

under Q&A “How do I lodge an objection on my GRV, UV or pastoral rent value”.

For information on how your values are calculated, please visit:

Visit Landgate for Property Valuations

Section 6.81 of the Local Government Act 1995 refers that rates assessments are required to be paid by the due date,of whether an objection or appeal has been lodged. In the event of a successful objection or appeal, the rates will be adjusted, and you will be advised accordingly. Credit balances may be refunded on request.

Can I pay my Rates by Instalments?

Providing that requirements for eligibility for the Rates Instalment Payment Option have been met, a ratepayer may pay their rates over two (2) or four (4) instalments. To qualify for the instalment option, ratepayers must pay any rate arrears and the full amount of the first instalment by the due date.

The payment must be received by the Town of East Fremantle by close of business on that date. No responsibility can be taken for any delays encountered in the delivery of the mail. The due dates for payment of rates by instalments for the 2023/2024 rating year are as follows:

Two Instalments:

|

First Instalment

|

23 August 2023

|

|

Second Instalment

|

3 January 2024

|

Four Instalments:

|

First Instalment

|

23 August 2023

|

|

Second Instalment

|

25 October 2023

|

|

Third Instalment

|

3 January 2024

|

|

Fourth Instalment

|

7 March 2024

|

What is my Customer Reference Number ?

Your Customer Reference Number is a unique number allocated to your rates account and will be required when you make a payment online.

Deferment of Rates

Rebates granted to Pensioners and Seniors under the Rates and Charges (Rebates and Deferments) Act 1992 are funded by the Government of Western Australia. Eligible Pensioners and Seniors can either obtain a rebate on, or defer, their Local Government Rates and their Emergency Service Levy charge. Rebates and deferment of rates only apply to Local Government Rates and the Emergency Service Levy charge. All other service charges must be paid in full by the due date. The amount of the rebate depends on the type of concession card an applicant holds.

Local Government Rates charges will be automatically deferred if the amount required to be paid on the rates notice is not paid by 30 June of the current financial year. Charges will not be deferred if the property is:

- occupied under a right to reside or life tenancy under the terms of a Will of a deceased estate,

- subject to co-ownership, other than spouse/de facto, where not all owners are eligible Pensioners,

- subject to a long-term lease in a retirement village, or

- occupied by eligible applicants that hold a WA Seniors Card only.

Deferment charges will remain as a debt on the property rates account until the amount is paid in full. Deferred rates and service charges are not required to be paid until the entitlement to defer ceases (i.e. applicant moves out, sells the property, dies and leaves no surviving spouse/de facto). Deferred rates and service charges may be paid at any time, but a rebate cannot be claimed when they are paid. Penalty interest is not applicable on deferred rates accounts.

How can I let you know I have changed my address?

It is essential that the Town of East Fremantle has the correct postal address recorded for each of its ratepayers. This is needed not only to ensure that notices are promptly received but also to ensure that when the Town undertakes community consultation all affected ratepayers are notified. To protect ratepayers against unauthorised changes of address in the Town’s records, we require all changes of address to be completed in writing. You can submit the electronic change of details form below or you can email the Town of East Fremantle at admin@eastfremantle.wa.gov.au.

Download Change of Details Form

Interim Rates

Some ratepayers may receive amended rate notices during the financial year, this notice is called an Interim rates notice. These notices are required to be issued if Landgate, Western Australia's land information authority considers that the Gross Rental Value (GRV) of a ratepayers' property has changed. Any alterations to a property could cause the GRV of your property to be revalued. Scenarios which could trigger a revaluation of the GRV of a property and the need to issue an Interim Rates Notice include:

- Creation of a new property, If a lot is created from a subdivision, amalgamation or strata title.

- Improvements or additions to the property, Installation of a swimming pool, construction of a garage or carport or the addition of a bedroom.

- Demolition of a property, this is usually the first step in the redevelopment of a site and only the first in a series of interim rate adjustments.

- Removal of a swimming pool or change of rubbish bin services to a property.

Penalty Interest on overdue amounts

To ensure that the many ratepayers who pay their rates accounts to the Town by the due dates are not disadvantaged, the Town of East Fremantle has resolved that it will charge interest on rates balances which remain unpaid after the due date. Section 6.51 (1) and subject to section 6.51 (4) of the Local Government Act 1995 and regulation 70 of the Local Government (Financial Management) Regulations 1996, allows for interest to be charged on 'Overdue Amounts' which are defined as rates which remain outstanding beyond the due date specified on the Annual Rates Notice.

The maximum interest rate which can be charged on outstanding rates amounts is prescribed by the Local Government (Financial Management) Regulations 1996 and is calculated daily on amounts that are not paid within 35 days of the issue date of the notice. 11% will be charged for the 2023/24 financial year.

Who pays Local Government Rates

Anyone owning residential or commercial property in the Town of East Fremantle is a ratepayer and is required to pay rates. Some government bodies, educational and registered charitable organisations are exempt from paying Council rates. Annual Rates Notices are issued by the Town of East Fremantle early in the financial year and are due 35 days from the date of issue. The overall objective of the proposed rates in the Budget is to provide for the net funding requirements of the Town’s services, activities, financing costs and the current and future capital requirements of the Town, after taking into account all other forms of revenue.

Alternative Payment Arrangements

If you are having difficulty paying your rates, the Town of East Fremantle has a range of assistance measures to help you. Payment arrangements are facilitated in accordance with Section 6.49 of the Local Government Act 1995 and will be offered to rate payers in situations of vulnerability. A special payment arrangement must be negotiated to reflect a ratepayer’s capacity to repay outstanding rates and contain the details of the agreed repayment schedule. These special payment arrangements will include the following:

-

It is the responsibility of the ratepayer to ensure that the agreed payment amounts are paid on or before the agreed due date.

-

The Town of East Fremantle requires full payment of the outstanding rates by the end of the financial year. If a ratepayer requires an extension on this time frame, an end date must be established and approved by the Executive Manager Corporate Services.

-

The ratepayer will be responsible for informing the Town of any change in circumstance that compromises the agreed repayment schedule.

The Town will waive all interest and administration charges where a ratepayer meets the Financial Hardship Criteria and enters into a special payment arrangement on the provision that all rates arrears are paid in full. For the purpose of recovering rates and service charges, any debt that remain outstanding by the end of the financial year, may be subject to the Towns debt recovery procedures prescribed in Policy 2.1.7 Debt Recovery.

Download interactive Payment Arrangements Form

Download printable Payment Arrangements Form

Download Financial Hardship Application

Download Policy 2_1_7_Debt_Collection

Information about Concessions

Am I eligible for concessions?

Rebates granted to Pensioners and Seniors under the Rates and Charges (Rebates and Deferments) Act 1992 are funded by the Government of Western Australia. Eligible Pensioners and Seniors can either obtain a rebate on, or defer, their Local Government Rates and their Emergency Service Levy charge.

Rebates only apply to Local Government Rates and the Emergency Service Levy charge. All other service charges must be paid in full by the due date. The amount of the rebate depends on the type of concession card an applicant holds.

The rebate of Local Government Rates and Emergency Service Levy charge shall be applied in accordance with the Pensioners and Seniors Concessions Scheme, with a result that If an applicant is a Pensioner or Senior, they can apply to receive a rebate or concession on charges for Local Government Rates and other service charges.

Eligible Property Owners

The Eligibility Criteria for rebates are as follows.

The applicant must be the owner and reside in the property on 1 July of the rating year.

There must be no rates in arrears from a previous financial year unless a payment arrangement has been entered into.

If the applicant is a Pensioner, they must be in receipt of a current pension and hold a current Pensioner Concession card.

An applicant in receipt of both a Seniors card issued by the Department Communities and a Commonwealth Seniors Health Card has the same entitlements as a Pensioner.

A Senior, must hold a current Seniors card issued by the Department of Communities.

To own means an applicant must:

be the registered owner or co-owner of the property on the Certificate of Title (where the property is co-owned a partial concession may apply), or

have a right to reside or life tenancy at the property under the terms of a Will (probate) and be responsible for the payment of rates and charges raised against the property, or

hold a long-term lease (greater than 5 years) in a retirement village, park home, lifestyle village or caravan park.

Rebate or Deferment Option

Pensioners who meet the eligibility criteria below are entitled to claim a rebate of up to 50% against the current year’s rates. The rebate amount is limited by the maximum amount set by the State Government. A Pensioner may also choose to defer paying their rates but will forgo their rebate entitlement in doing so.

Rebate Option

To claim a rebate, eligible concession card holders will be required to pay the amount due on the rate notice by 30 June of the current financial year.

If payments are received after the due date, an applicant will lose the rebate for that financial year and must pay the full amount due. Local Government Rates charges will be automatically deferred if the amount required to be paid on the rates notice is not paid by 30 June of the current financial year.

Deferment Option

Local Government Rates charges will be automatically deferred if the amount required to be paid on the rates notice is not paid by 30 June of the current financial year. Charges will not be deferred if the property is:

occupied under a right to reside or life tenancy under the terms of a Will of a deceased estate,

subject to co-ownership, other than spouse/de facto, where not all owners are eligible Pensioners,

subject to a long-term lease in a retirement village, or

occupied by eligible applicants that hold a WA Seniors Card only.

Deferment charges will remain as a debt on the property rates account until the amount is paid in full. Deferred rates and service charges are not required to be paid until the entitlement to defer ceases (i.e. applicant moves out, sells the property, dies and leaves no surviving spouse/de facto). Deferred rates and service charges may be paid at any time, but a rebate cannot be claimed when they are paid. Penalty interest is not applicable on deferred rates accounts.

Pro-rata Provisions

When applicants become eligible Pensioners or Seniors during a financial year, it is important that they advise the Town as soon as possible. The pro-rata provisions allow for a rebate based on the date of registration during that financial year (i.e. calculated on how many days of that year an applicant was registered).

Change in Circumstances

Eligible Pensioners and Seniors Concession card holders will be responsible for informing the Town of East Fremantle of any change in circumstance that jeopardises their rebate entitlements. Concession card holders must immediately advise the Town if they:

- are issued with a new card or their card is cancelled/expired,

- have changed any of their details that were provided on the original registration,

- sell or transfer an interest in all, or part, of the property or move to another address,

- have a spouse who ceases occupation of the property, or

- as a WA Seniors Card holder, become an eligible Pensioner or the holder of a Commonwealth Seniors Health Card.

What types of concessions are available?

You have the choice of either a REBATE on, or the DEFERMENT of, your Annual Water Service Charges, Local Government Rates and Fire and Emergency Services Levy.

To obtain a Rebate on your Rates, Water Service Charges and Emergency Services Levy you will need to pay the amount indicated on your notice by 30 June of the current financial year. (Refer to section How do I apply for a concession?)

Your Rates, Water Service Charges and Emergency Services Levy will automatically be deferred, where you are eligible.

If the amount required to be paid to receive a rebate is not paid by 30 June of the current financial year the deferment option is not available where the property:

- is occupied under a life tenancy or right of residency under the terms of a Probated Will of a deceased estate, or

- subject to co-ownership other than with a spouse/de facto partner), or

- you have eligibility for a Senior Concession only.

Please note, if the deferment option is not available, you must pay the amount indicated on your Rates or Water Service Charges notice before 30 June of the current financial year to receive the rebate.

Where do I find more information about Concession Cards?

Download Pension and Seniors Concession Scheme Fact Sheet

WA SENIORS CARD

Department of Local Government and Communities (WA Government)

Phone: (08)6551 8800 Country: 1800 671 233

8:30am to 4pm weekdays (except public holidays)

COMMONWEALTH SENIORS HEALTH CARD OR PENSIONERS CONCESSION CARD

Centrelink (Commonwealth Government)

Phone: 13 23 00

Commonwealth Department of Veteran Affairs

Phone: 9366 8222 or

Country 1800 113 304

STATE CONCESSION CARD

Family and Children's Services (WA Government)

Phone: 9222 2555 or

Country 1800 622 258

How do I apply for a Concession?

To apply for a concession, phone the Water Corporation Rebate Application Line on 1300 659 951 to submit a rebate application form over the telephone. To receive a Rates, Water Service Charges and Fire and Emergency Services Levy concession, you must register with either the Water Corporation or your Local Government. Your one application will be registered at both organisations. Your applications for registration will be effective from the day that either the Water Corporation or your Local Government first receives a completed registration form.

IMPORTANT

You can only claim a concession or deferment (where eligible) on one (1) property in any one rating year. This applies to the property owned and occupied as at 1 July.

Where arrears of your Annual Rates, Water Service Charges or Fire and Emergency Services Levy exist, a concession may be available where you enter into, and satisfy, a payment arrangement to clear the arrears.